I went to another taping of Real Time with Bill Maher down the street at CBS’s Television City primarily to hear Nobel Prize winning economist Muhammad Yunus. After scoring the tickets, I saw that MIA had been added to the lineup I assumed to talk about the devastation of Tamil Eelam in northern Sri Lanka. Indeed Bill had MIA sit down for the first segment but he wasted the first few minutes asking her frivolous questions regarding her appearance at the Oscars. MIA, who is normally very confident, some would say even strident, actually appeared quite uneasy talking about the war in her ancestral land and seemed to have virtually no talking points prepared. Having recently written about the crisis myself I thought her appearance would be a continuation of her somewhat infamous Tavis Smiley segment in February. Bill then made an awkward analogy comparing Sri Lanka with 1994 Rwanda not comprehending that in Colombo, the government is run by the Sinhalese majority whereas in Kigali, it was precisely the opposite scenario with a Tutsi-led minority government. Bill may have been thinking of pre-1948 colonial Ceylon when it was considered that the British favored the Tamils in their divide et impera strategy? Not bloody likely. As usual, the context gets lost in the noise. Rwanda and Sri Lanka took very different post-colonial paths. When Ceylon became independent, it was by a Sinhalese-speaking majority thereby breaking the chain of British minority favoritism. Rwanda’s inherited divide and rule format was absorbed as policy upon independence. Both ways were paved paths to disaster. One a short outburst of hyper violence and the other a long war of attrition with a climatic ending.

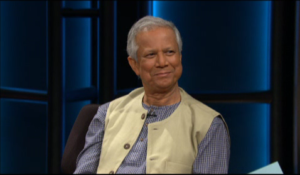

Muhammed Yunus on Real Time

The banker from Bangladesh, however, did not disappoint. Muhammad Yunus railed against overt materialism and capitalism devoid of a social context. While he was likely preaching to the converted, his message of banking with a conscience seems to resonate in a recession to a Western audience in a way that it may have otherwise not. He briefly mentioned bringing his Grameen Bank to New York which would account for the Grameen America office I spotted in Jackson Heights, Queens several months ago. Jon Meacham of Newsweek and economist Simon Johnson of MIT seemed to agree. Meacham cited the unifying qualities of the Great Depression and World War II taking Yunus’s point a line further in the notion that with great crises comes great opportunity. Within this shattered economy, there is a chance to reevaluate the descent of American virtue into the abyss. In Yunus’s Bangladesh, the quintessential global basket case, micro finance has brought a thousand points of light across a socio-region that otherwise may have taken generations to adapt by poor people traditionally being stifled in a politically and culturally top-down hierarchical society with an insular familial power structure. Meacham commented that Wall Street was also a top-down system that has failed us. A mix of a faltering, headless financial core with people in poverty whether in the United States or South Asia, is where micro finance can fill much more than what was originally considered by many to be a niche. The Grameen concept is an attempt to create an economic land bridge between traditional markets and what is referred to by Indian economists as the “Unorganized sector” which is a fanciful way of saying “People who do not pay into the taxation system nor receive anything from it.” Many Americans are forming a new unorganized sector here in the United States and they are doing it not by choice.